What are the configurations to be checked for HSN related Issues?

- Verify if valid HSN code is maintained (check for the HSN code from E-invoice portal, HSN should exactly match with E-invoice portal HSN code)

Path: https://einvoice1.gst.gov.in/Others/MasterCodes -> Select HSN code ->Select HSN chapter (HSN series) - HSN code may be missing/Incorrect – Update HSN code against material in SAP material master

What is to be done when you get an error description as “Supplier Address is not maintained”?

Maintain the Supplier Address in Plant Master in SAP for Billing and Business place or Plant address in SAP for Direct FI Transactions and then refresh the OptiE-Invoice Cockpit screen.

While trying to run the OptiE-Invoice cockpit screen, are you facing the issue as “Invoice/document not found in cockpit”?

Check for the below options:

- The invoice maybe a cancelled invoice

- The configuration for that type of invoice might not be done yet.

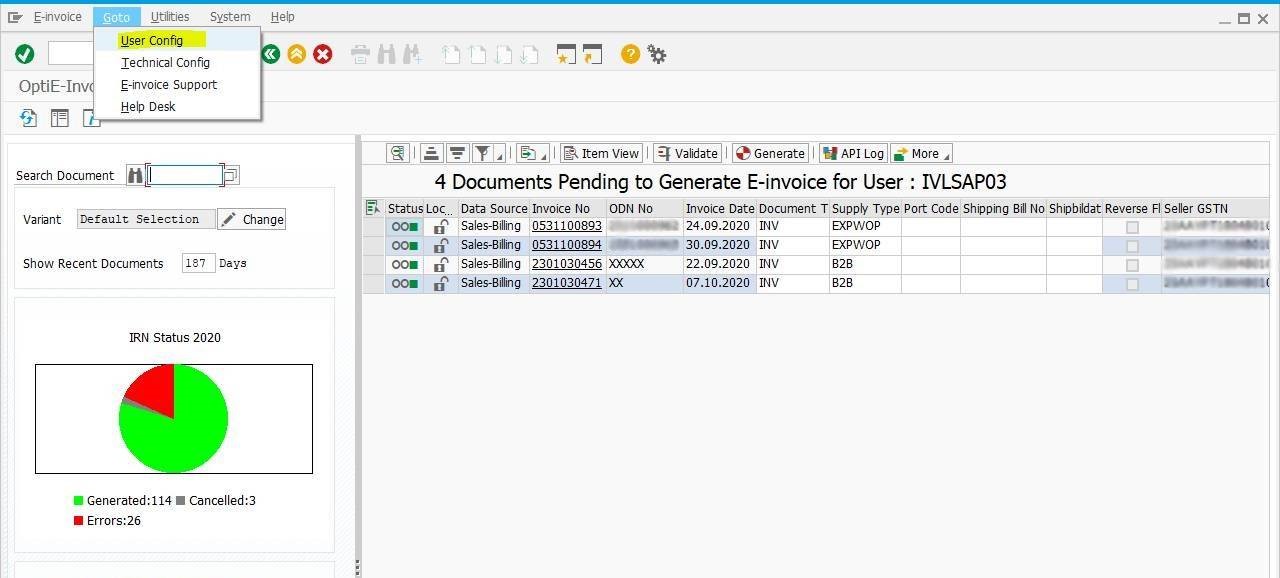

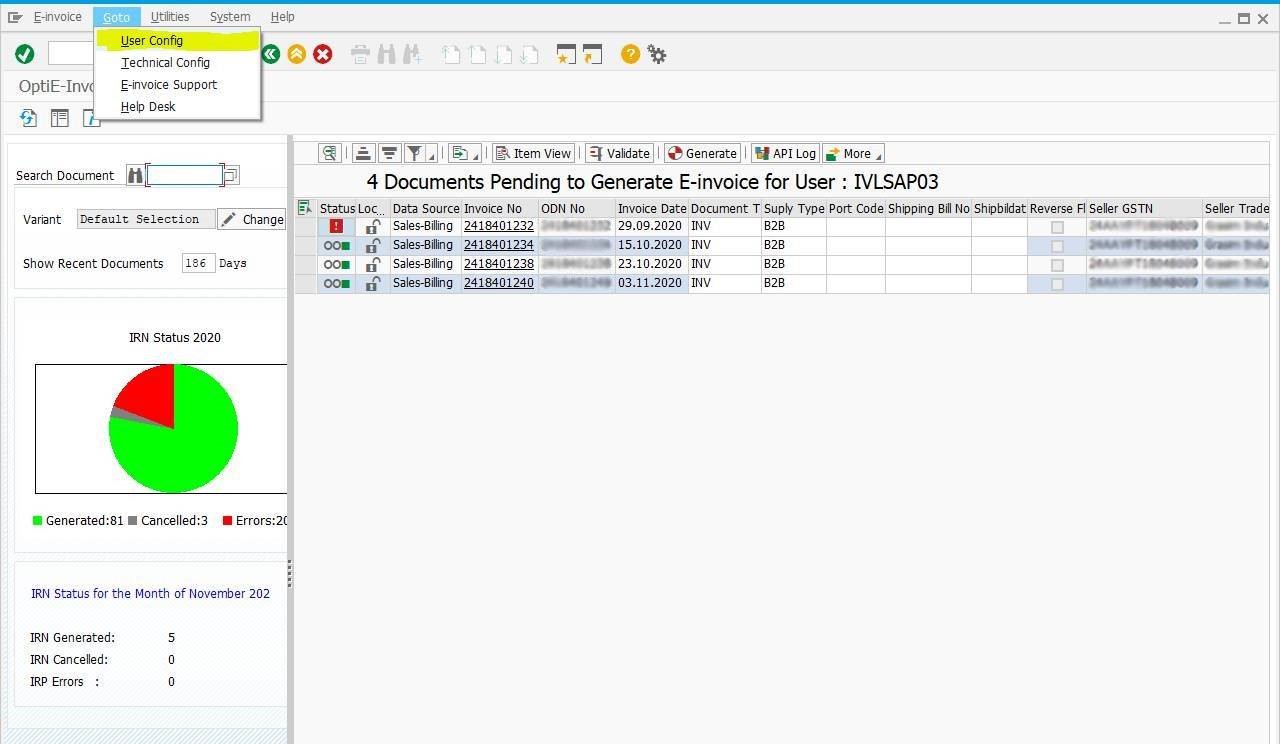

Path: OptiE-Invoice cockpit -> Goto menu -> User config -> Sales -> OptiE-invoice: Maintain Sales Document Types/ Finance à OptiE-invoice: Maintain FI Document Types - The IRN for the invoice maybe already generated

Path: OptiE-Invoice cockpit ->(Give Date Range) -> More Button -> E-Invoice Status Report - The customer tax classification maybe wrongly maintained

Path: OptiE-Invoice cockpit -> Goto menu -> User config -> Common Config -> OptiE-invoice: Maintain Customer Tax Classification - The selection screen criteria may be wrongly entered

- The document accounting is not released

- Clear user name in cockpit selection screen

- GSTIN not maintained/invalid GSTIN format

- Seller and buyer belongs to the same GSTIN

Is there any difficulty to scan QR code?

Please download the latest QR code scanner app from the IRP portal (https://einvoice1.gst.gov.in/Others/QRCodeVerifyApp) and also please scan the QR code after downloading the PDF of the print.

While trying to generate IRN, are you getting an error as “IRP attributes not maintained”?

Add the company code business place configuration in IRP attributes, provide GSTIN number, API username, and password. Please reach out to OptiE-Invoice support team to maintain the configurations in OptiE-Invoice module.

Path: OptiE-Invoice cockpit -> Go to menu à Technical config ->OptiE-Invoice: IRP Integration Configurations -> Optie-Invoice: Maintain IRP Attributes

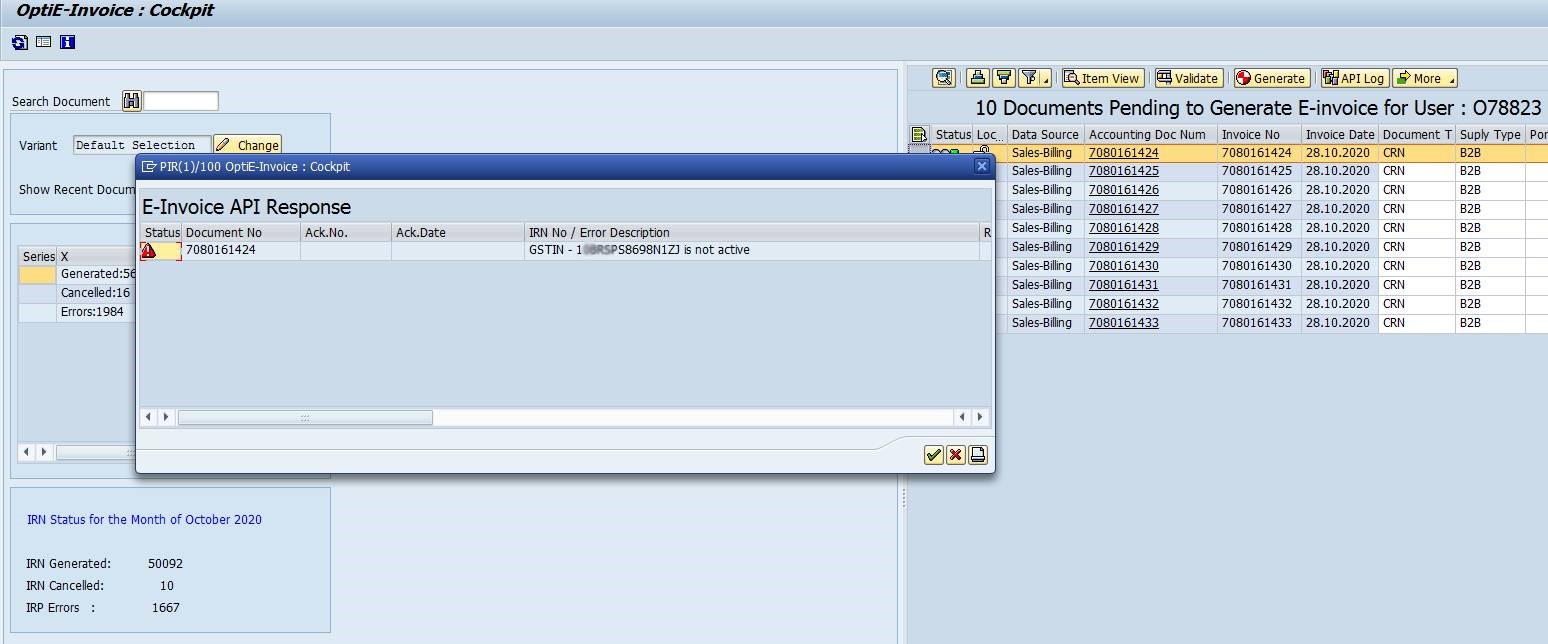

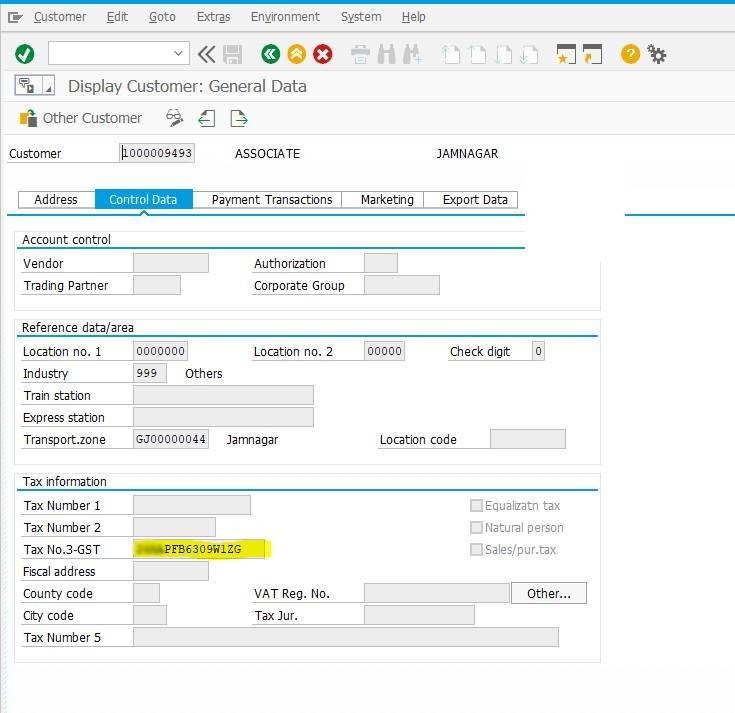

Are you getting the error GSTIN number is invalid/inactive?

When the buyer fails to file returns for 2 consecutive months, the portal will block GSTIN. Until buyer files return GSTIN will be blocked. Later GSTIN will become active in GST portal, however it may require some time to sync GSTIN from E-invoice portal(https://einvoice1.gst.gov.in/Others/TaxpayerSearch)

Check whether the GSTIN number is active or a valid one online.

If the GSTIN number is invalid, replace the Customer Master with the Customer GSTIN no. and refresh the OptiE-Invoice cockpit screen. So, you can use the same document for IRN generation.

Correct the GSTIN number in the customer master.

Why is GST rate not getting fetched?

The tax code and condition type may not be configured.

Check the billing document, whether the document is having a GST amount, and if the document has a GST amount, then check the master data, if the condition type and tax code are maintained for the document.

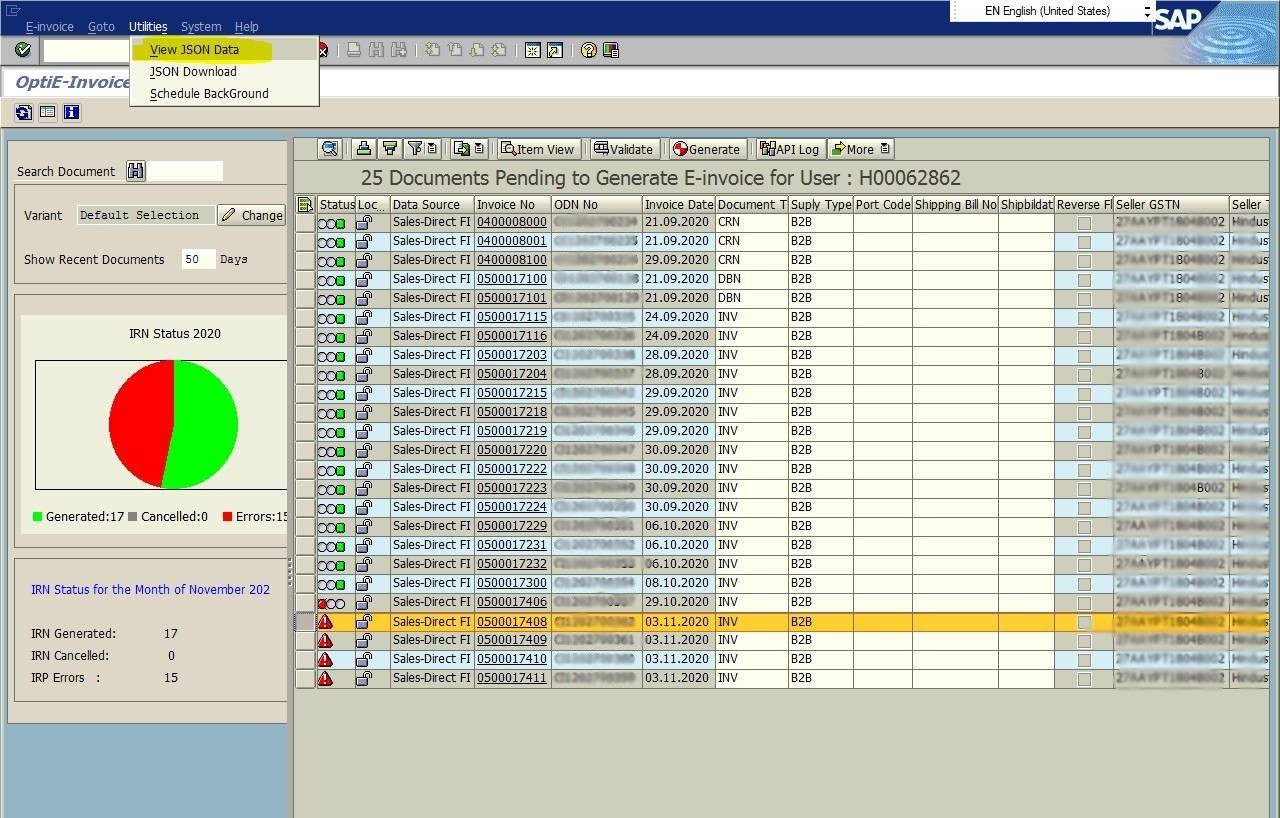

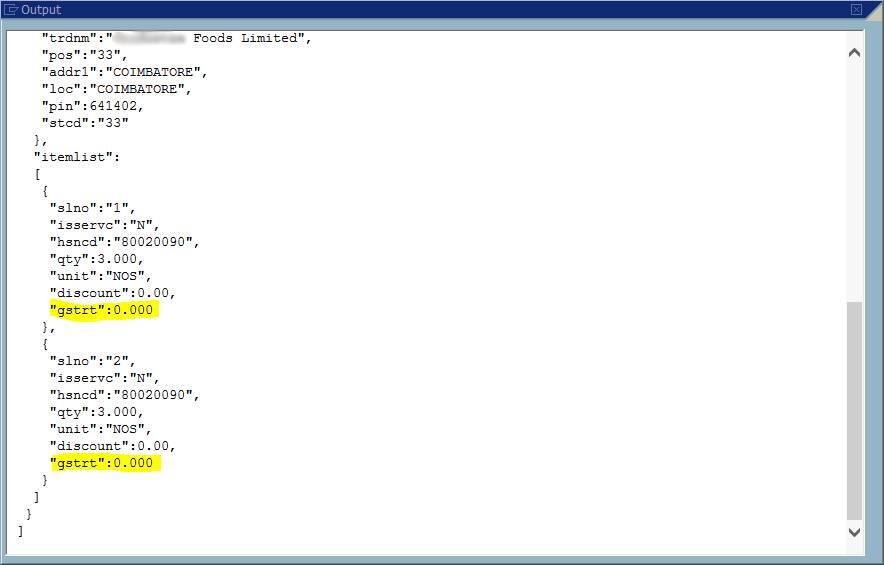

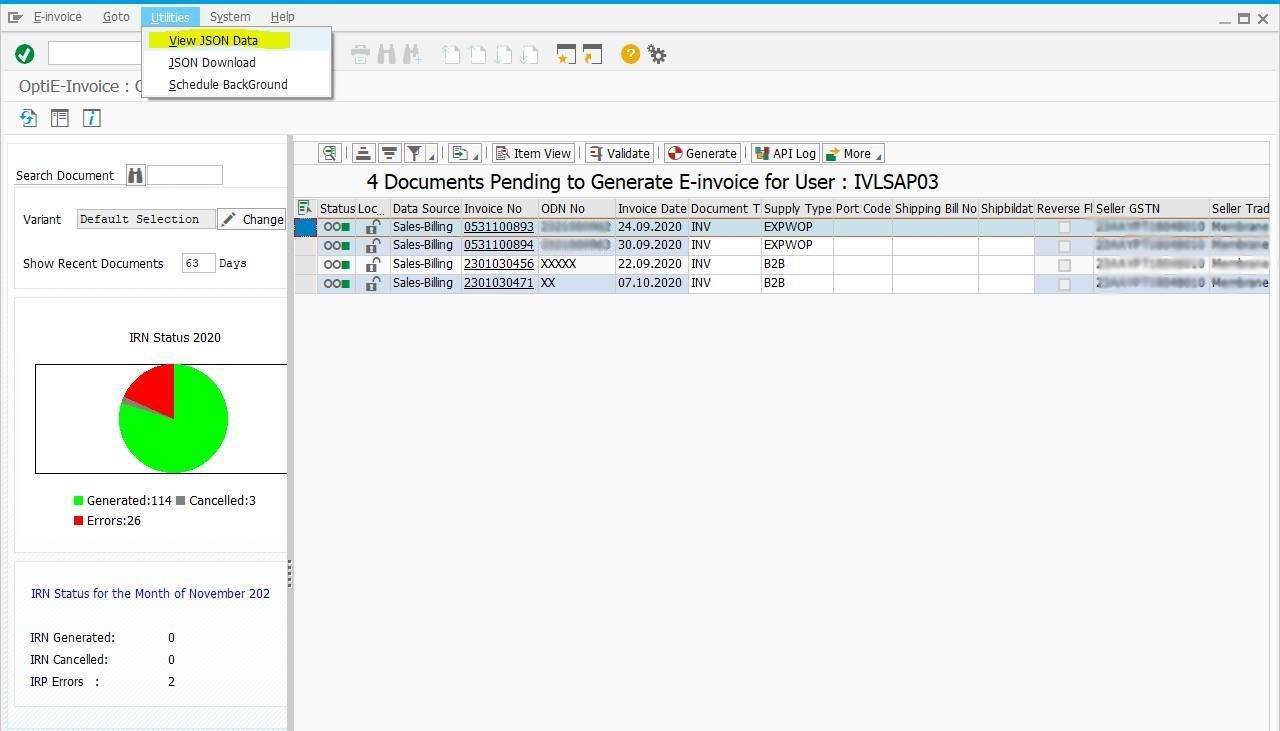

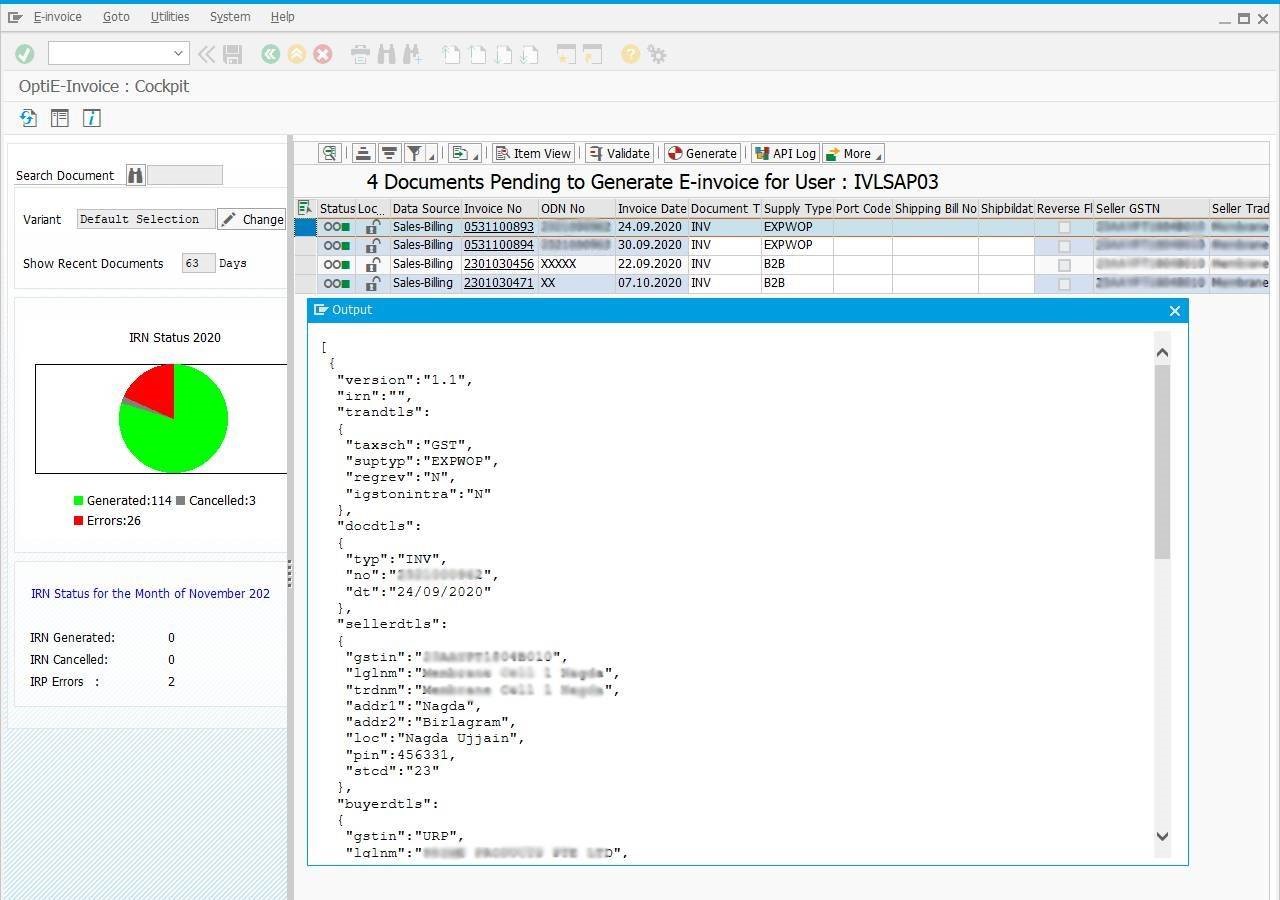

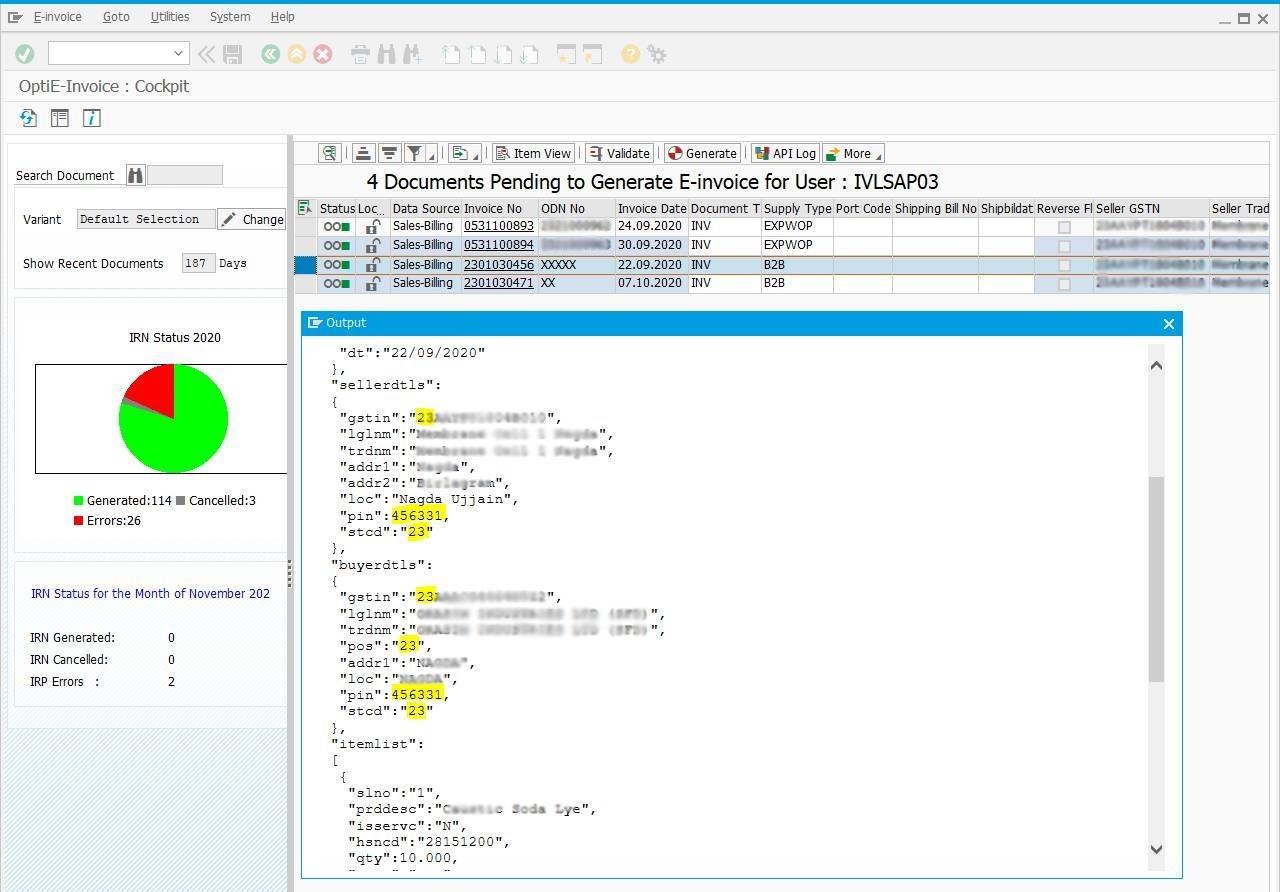

View the JSON for this document.

To view the JSON follow the below steps.

-

- Click on the document and from the menu bar click on utilities

- Then click on view json data.

Here you can see that the gstrt is blank, which means that the taxcode/condition type isn’t configured. So, we need to configure that particular taxcode and condition type.

Are you getting an application error as “contact customer desk”?

Pin code not belongs to the state – Pin code state code and GSTIN state code should match. In differ cases, update the correct pin code in the customer master

Pin code validation with portal->https://einvoice1.gst.gov.in/Others/PincodeSearch.

Verify the Address master of the Customer and check for the region and pin code, because for IRP GSTIN no. first 2 digits, State code and Pin code should match.

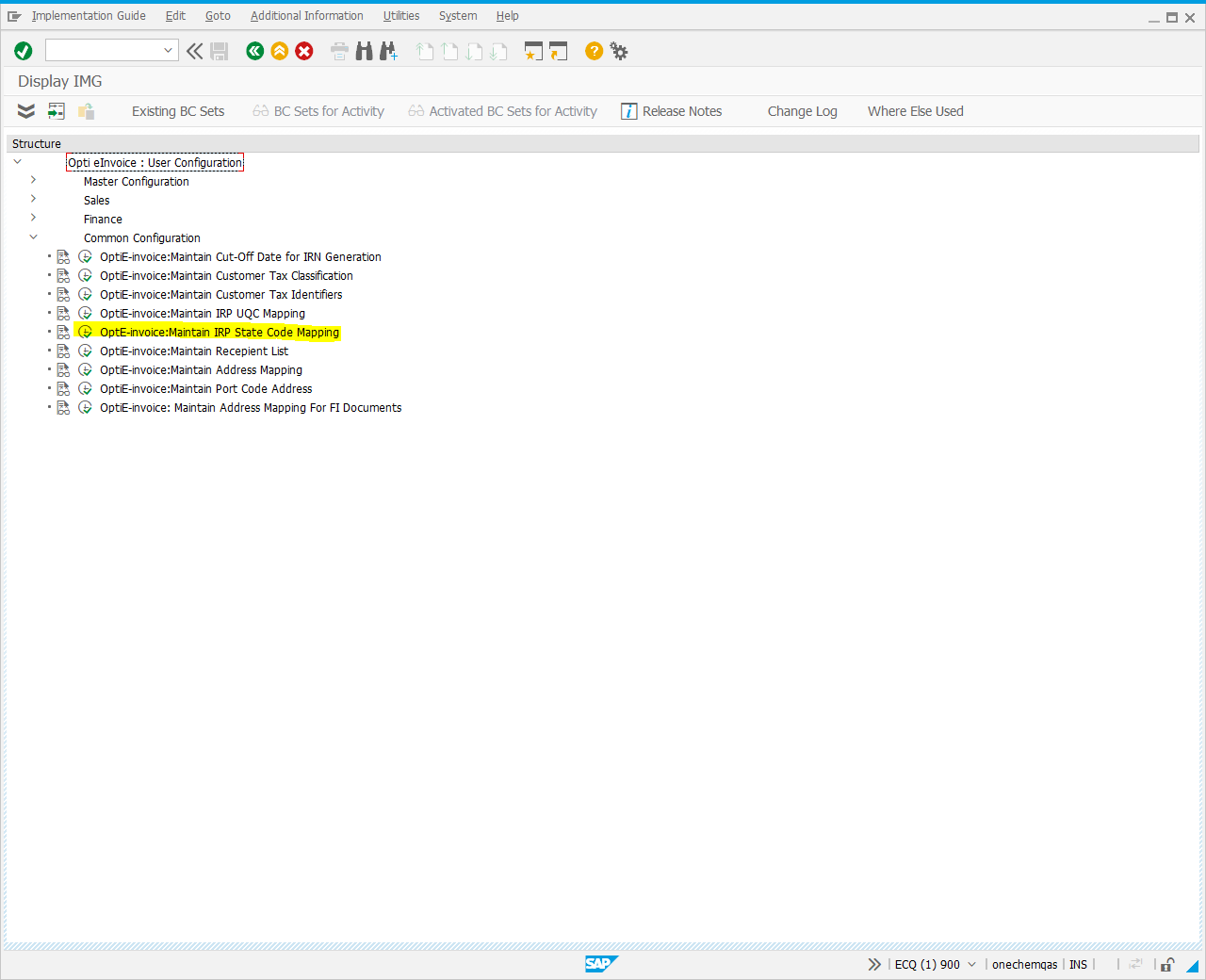

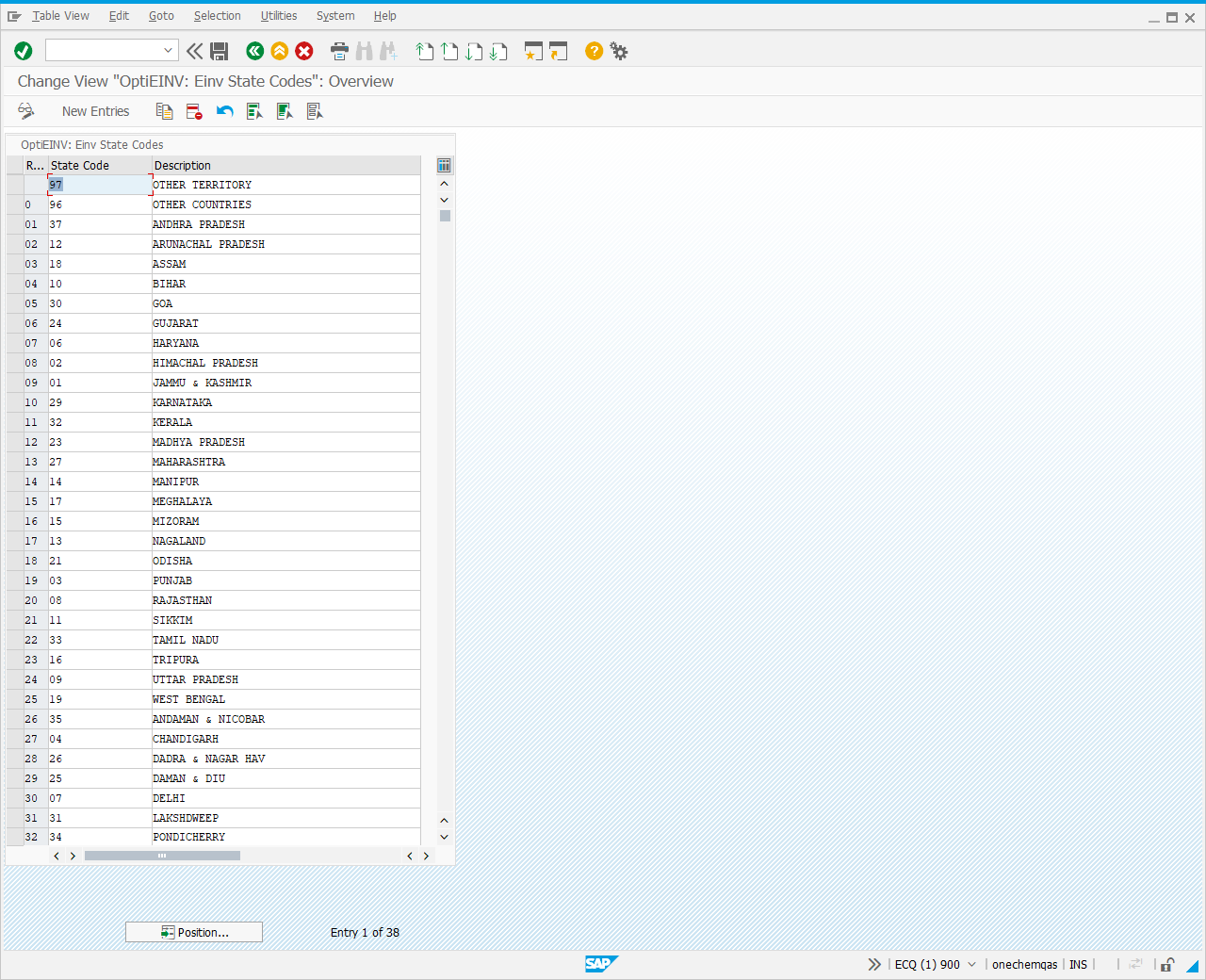

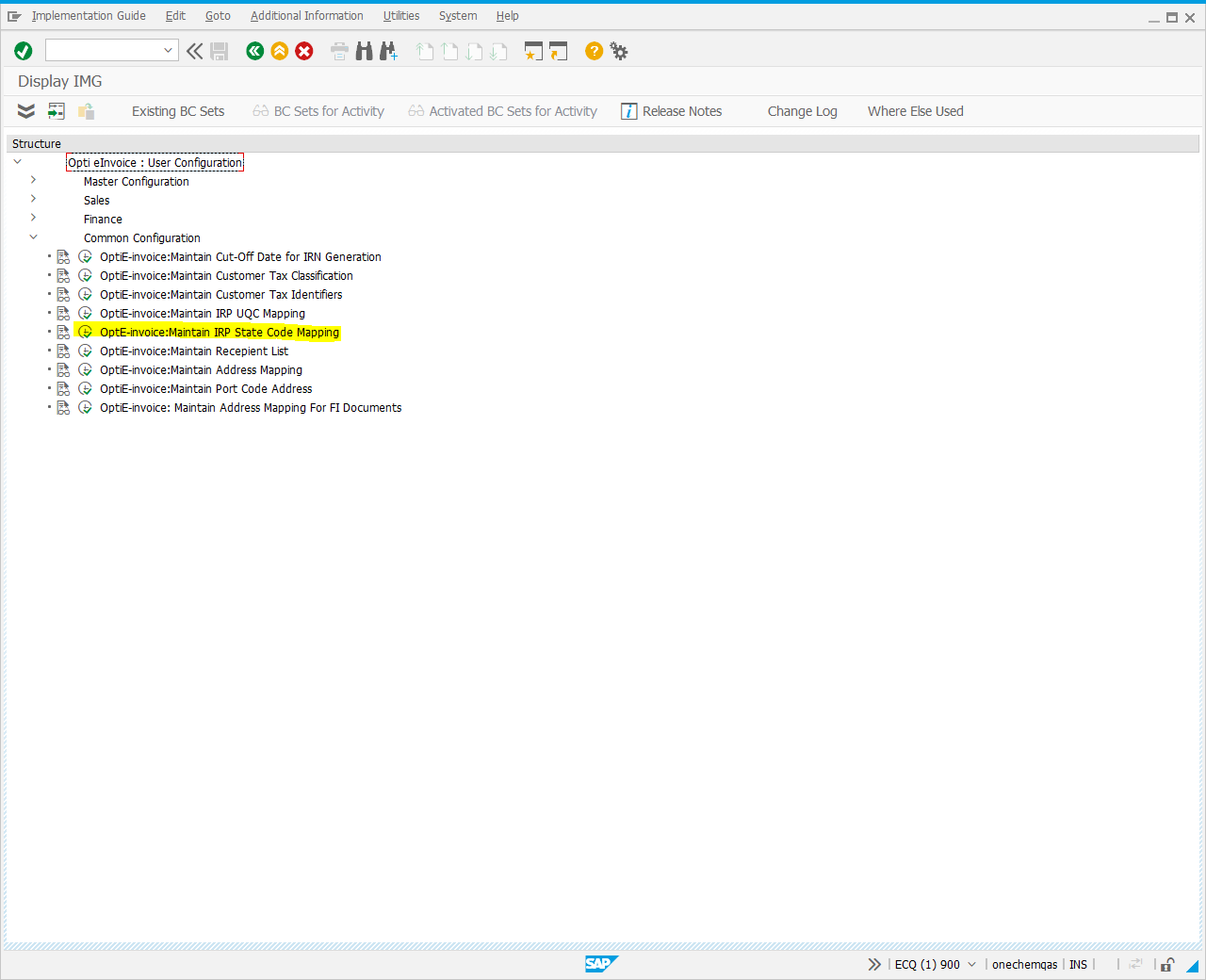

To view the state code mapping. Follow the below steps.

-

- Click on Goto in the menu bar and select user config.

- Select OptiE-invoice: Maintain IRP State Code Mapping under the common configuration

.

- Invalid pin code (validation from portal https://einvoice1.gst.gov.in/Others/PincodeSearch)

- Click on Goto in the menu bar and select user config.

Are you getting an error as tax value not matching?

For inter-state transactions, CGST and SGST amounts are not applicable. Only IGST is applicable

Do you have an error as supplier and recipient GSTIN are same?

IRN is not allowed when Supplier and recipient GSTIN are same, it should be different.

What to do when you get DATA to JSON conversion error?

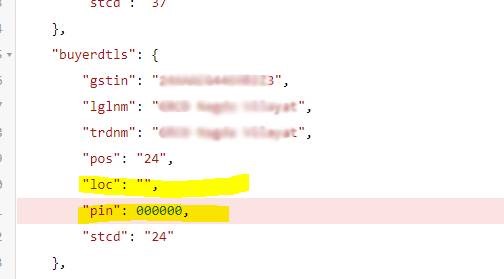

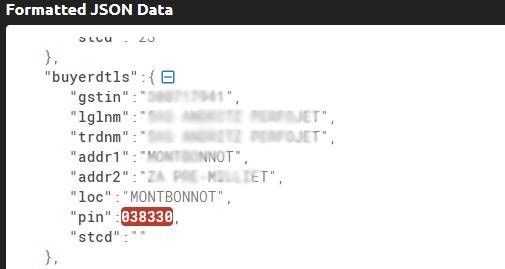

If any details of supplier/ buyer are missing or invalid data format. Such as missing pin code, space, state code, special characters in the fields from where the data is transported

Do you have an error message as Distance field is required?

While generating E-way bill along with E-invoice distance is mandatory.

Are you getting the error message as “the field Product Description must be a string with a minimum length 3”?

The material description should be more than 3 characters.

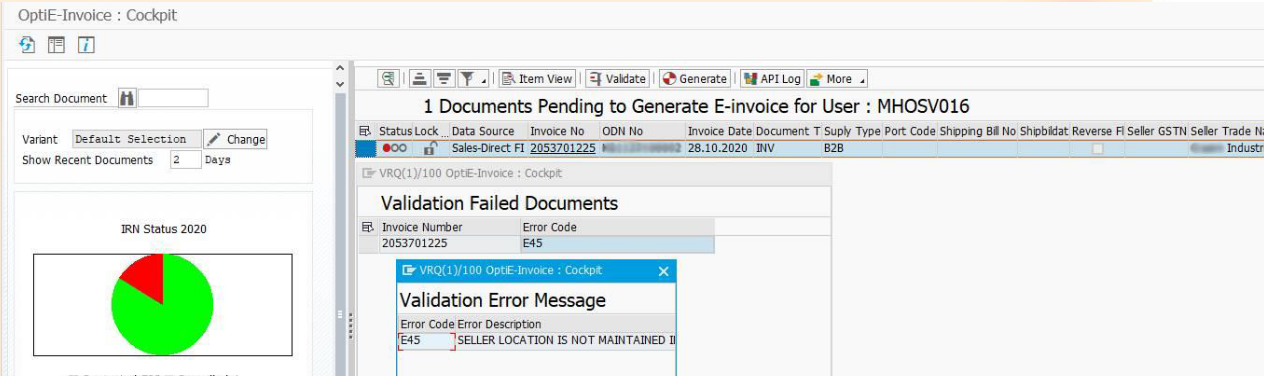

Do you have any error as E45 E02 or Pin code?

Maintain the pin code correctly in SAP or check in the IRP portal if the pin code is listed using the search option.

Why Cancelled invoices are not showing in cockpit?

The cancelled invoices will not be shown, but if there is a credit/debit done for the cancelled document, that will be listed with the reference number

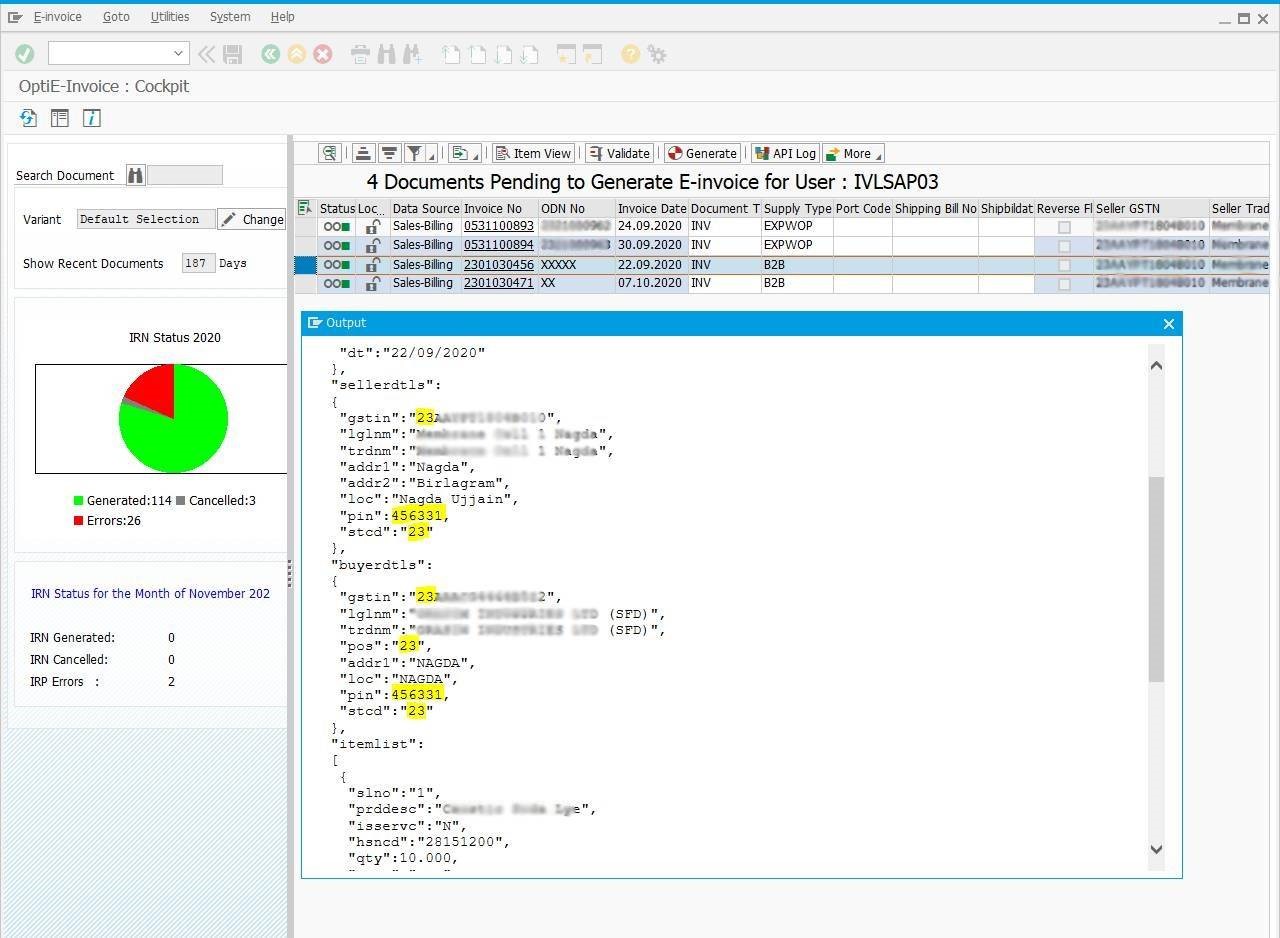

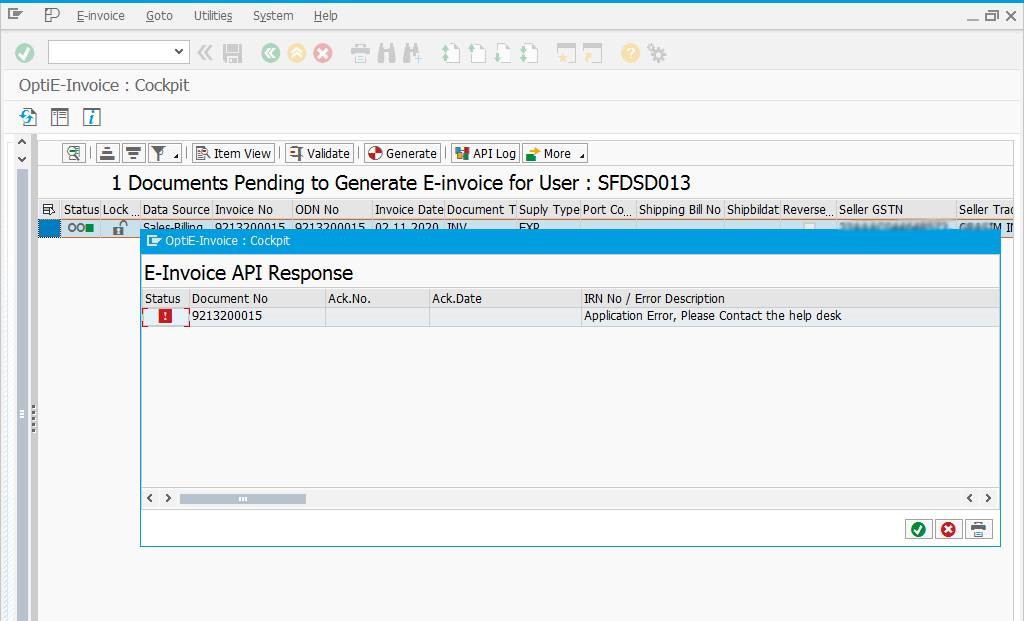

What to do if IRP portal throws an error saying “Application Error, please contact the help desk.”?

Check the JSON for this particular document.

To view the JSON follow the below steps.

-

- Click on the document and from the menu bar click on utilities.

- Then click on view json data.

Here you can view and see if there is any missing data.

At times we see that the Govt API does not return a suitable error message.

Mostly we see that the error in those cases is that the address is not maintained correctly.

Please check JSON - the value of LOC field (City) or pin code or state code might be missing.

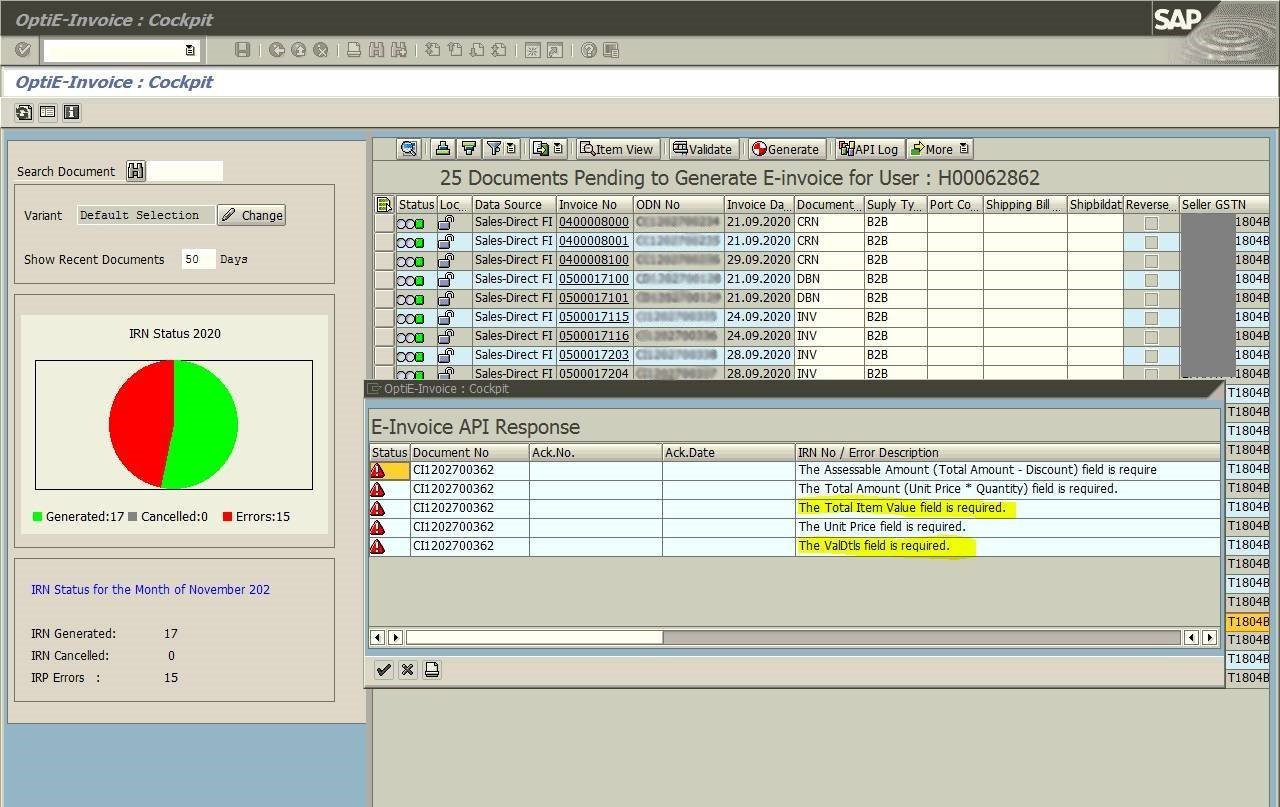

Example screenshots of reasons for errors.

If the error from the IRP portal is Pin code and State code is not matching with the GSTIN no.?

Verify the Address master of the Customer and check for the region and Pin code, because for IRP GSTIN no. first 2 digits, State code, and Pin code should match.

Path: OptiE-Invoice Cockpit -> Goto Menu -> User Config -> Common Configuration -> OptiE-invoice: Maintain IRP State Code Mapping

To view the state code mapping. Follow the below steps.

- Click on Goto in the menu bar and select user config.

Select OptiE-invoice: Maintain IRP State Code Mapping under the common configuration.

Unable to generate the E-invoice for a particular business place or plant.

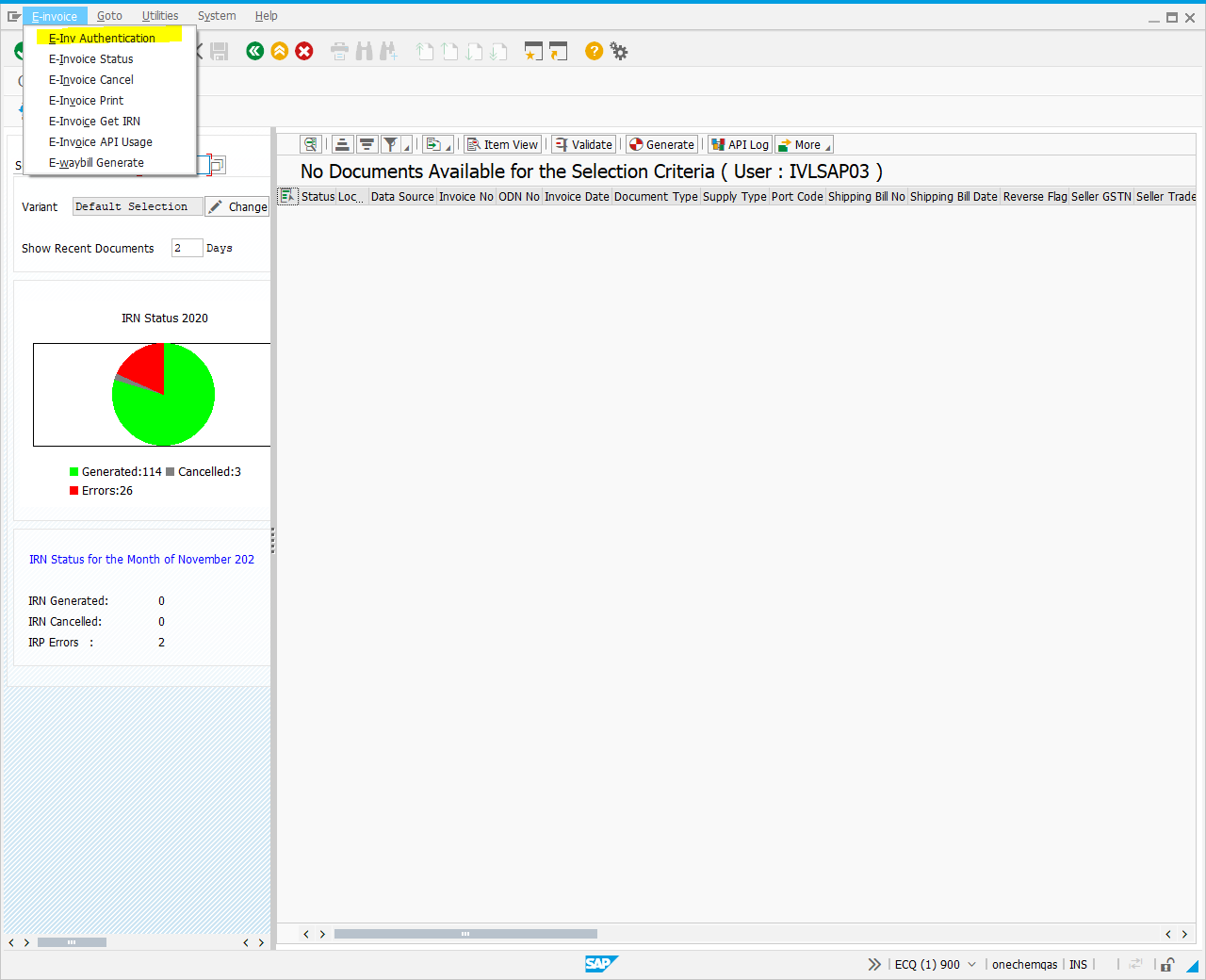

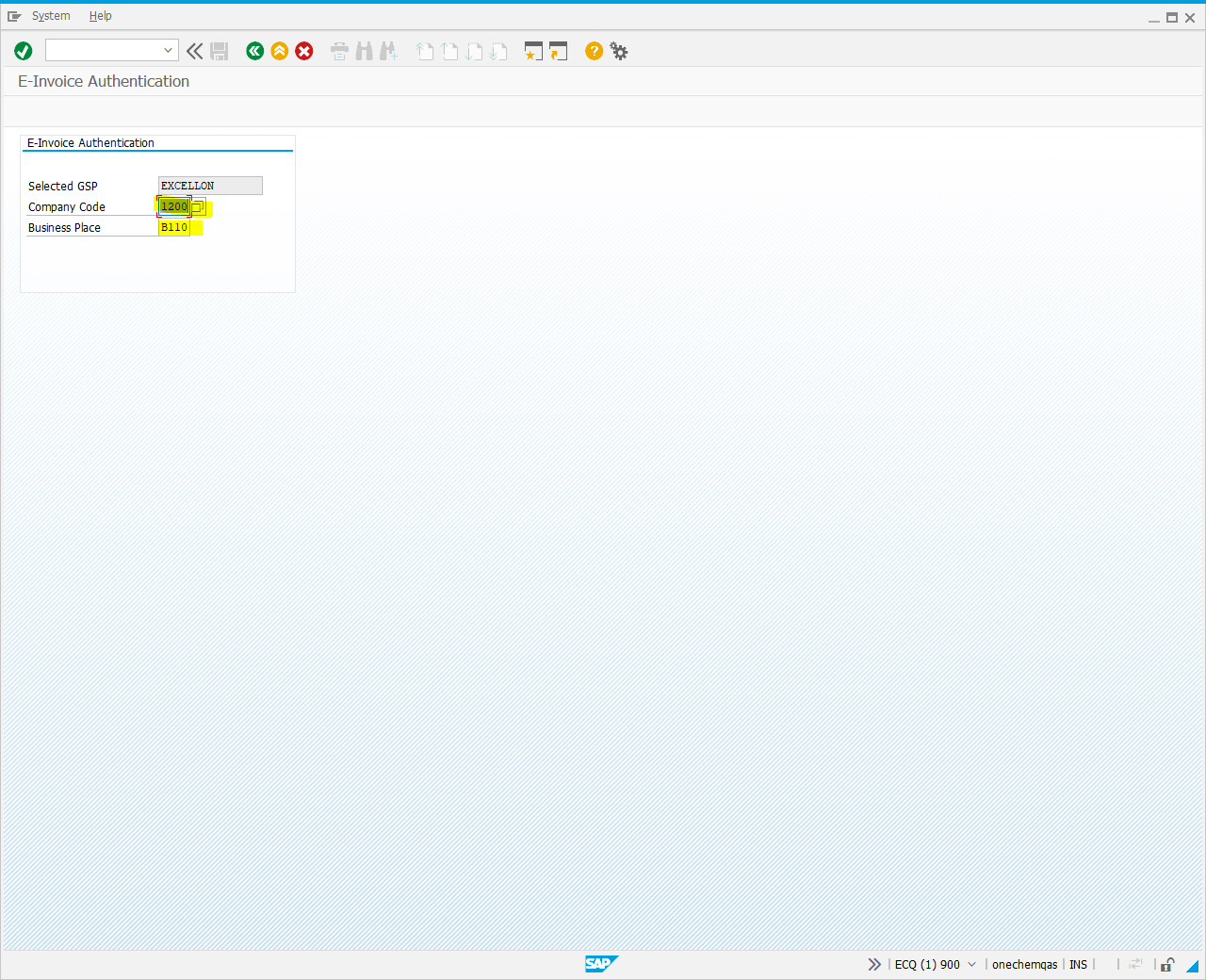

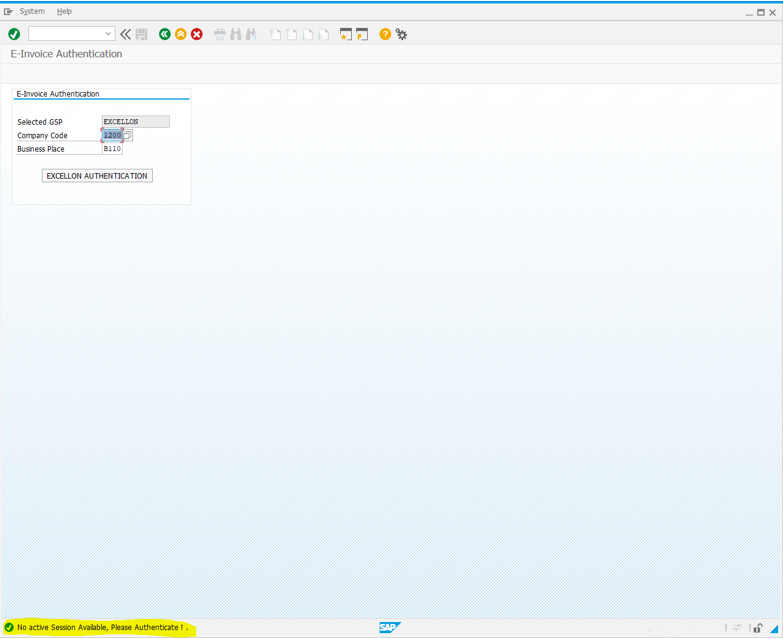

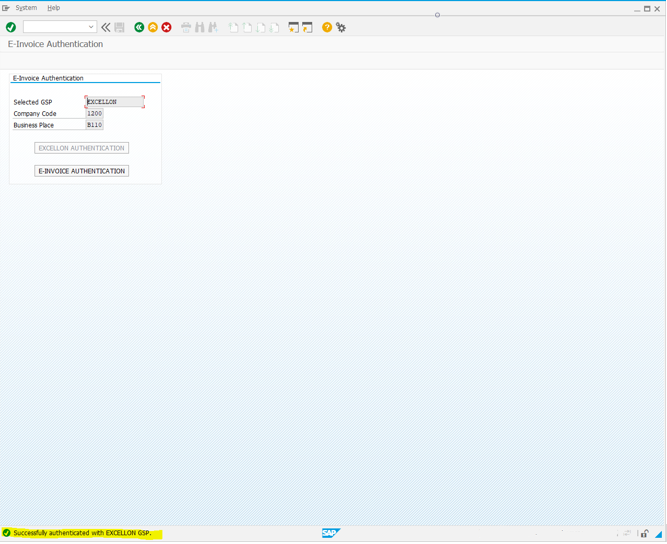

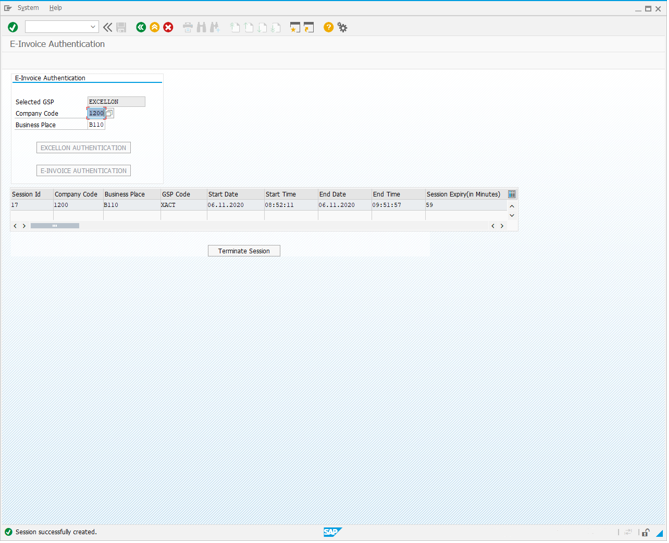

Try authentication again from E-invoice.

For authentication, please follow the below steps

Path: OptiE-Invoice Cockpit -> E-Invoice -> E-Inv Authentication

Select the Company code and business place from the search help.

Press Enter.

Click on Excellon Authentication.

Click on E-invoice Authentication.

If the authentication fails, we need to check the username and password configured for that business place and company code.

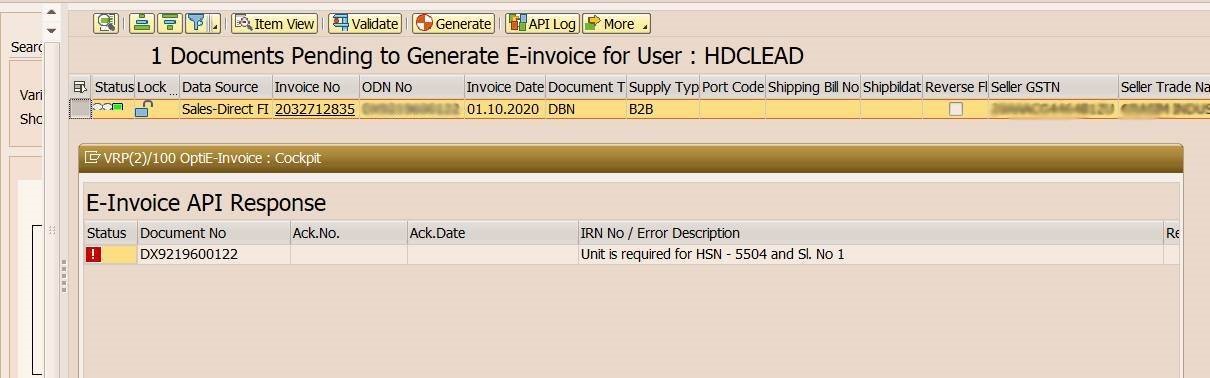

What to do if the error from IRP portal is “Unit is required for HSN – XXXX and SL No X. “?

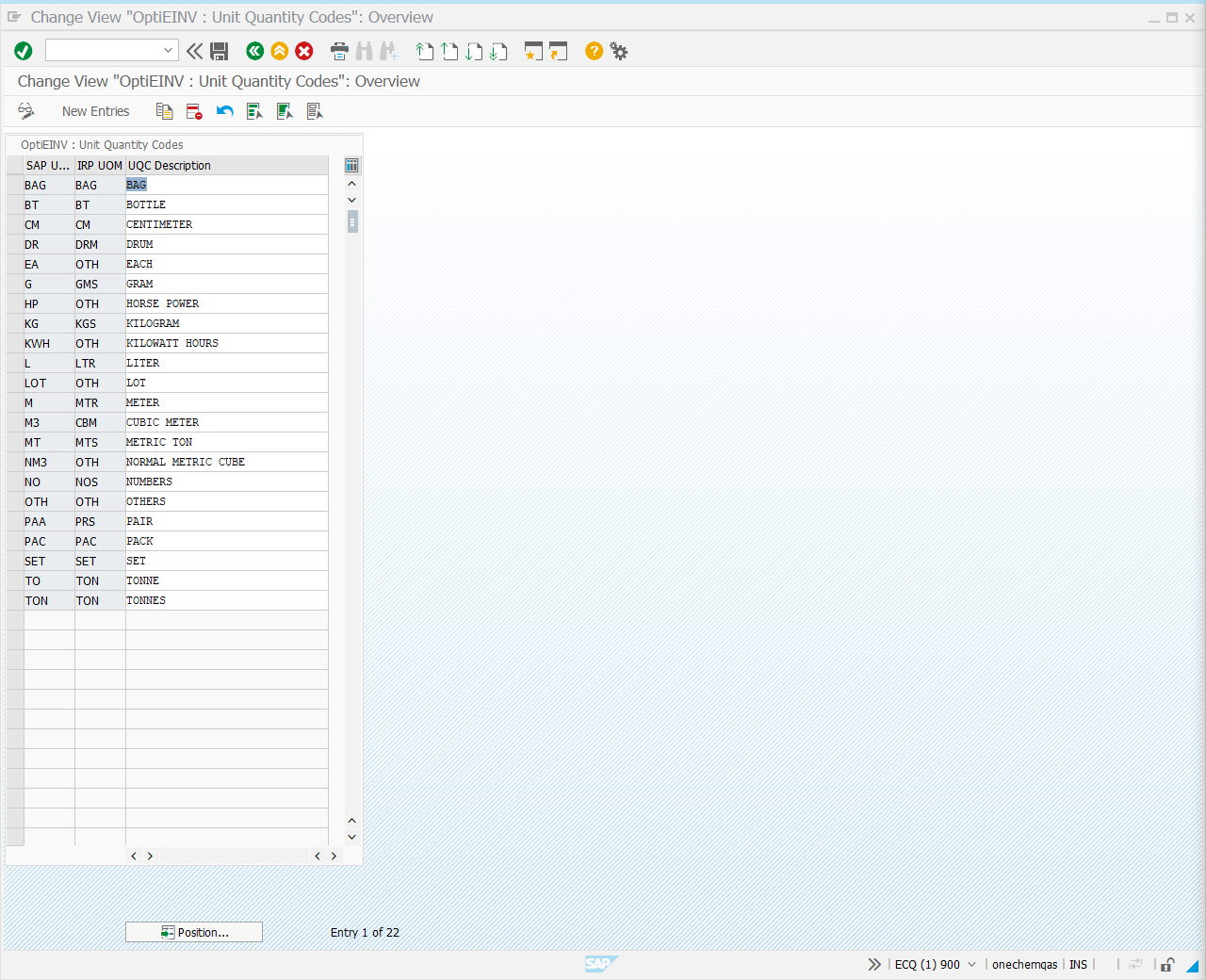

Check if the Unit is maintained in the UQC mapping.

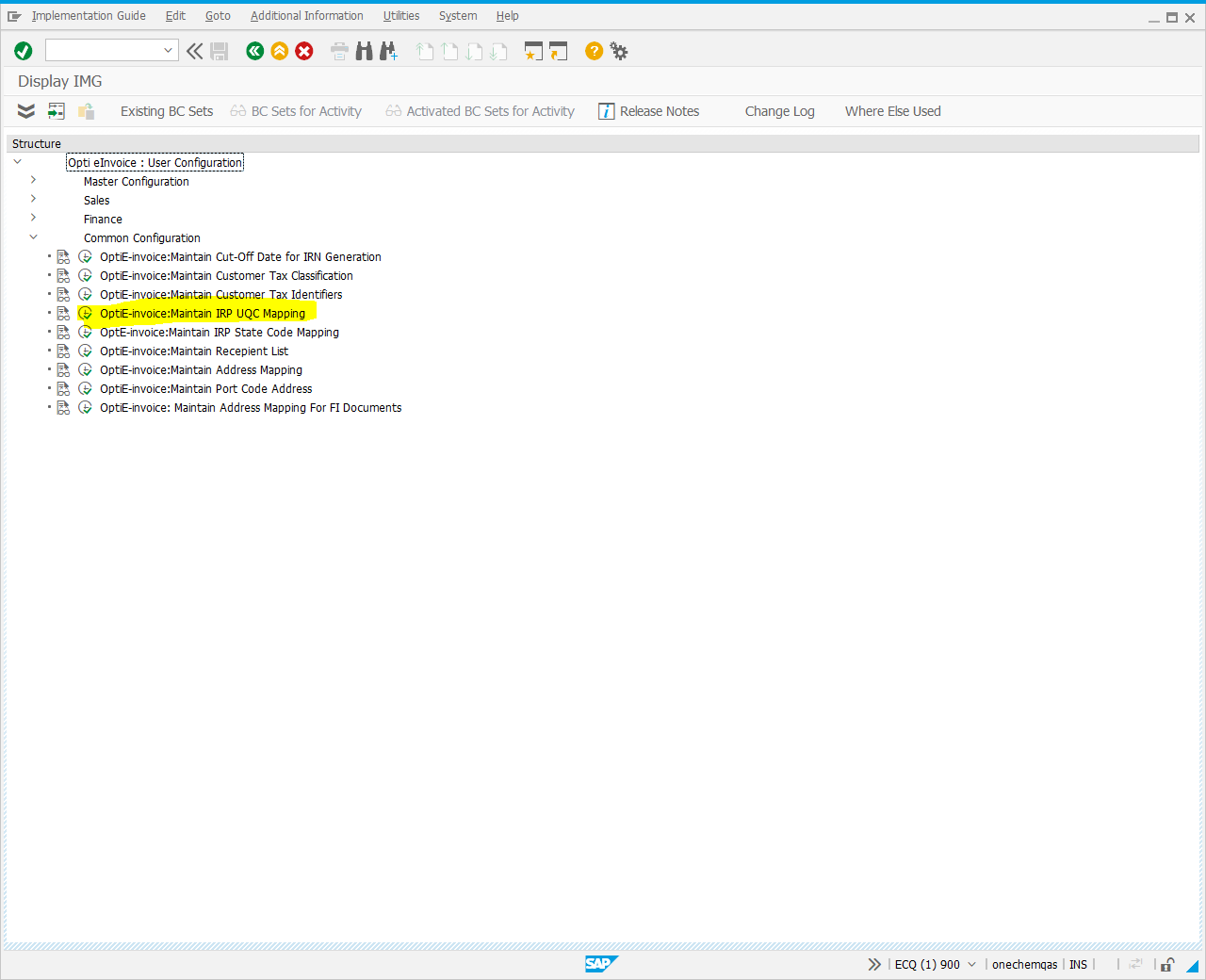

Path: OptiE-Invoice Cockpit -> Goto Menu -> User Config -> from the menu bar and click on user config -> Common Configuration -> OptiE-invoice: Maintain IRP UQC Mapping.

Select OptiE-invoice: Maintain IRP UQC Mapping under the common configuration.

Add in the UQC mapping if that unit isn’t mapped here.

System Error Code and its Description

| Field Name | Error Code | Error Description |

| BILLTOADDR1 | E62 | BILL TO PARTY ADDRESS1 IS NOT MAINTAINED IN ADDRESS TABLE |

| BILLTOGSTIN | E13 | BILL TO GSTIN NO IS NOT MAINTAINED /INVALID |

| BILLTOLGLNM | E61 | BILL TO PARTY LEGAL NAME IS NOT MAINTAINED IN ADDRESS TABLE |

| BILLTOLOC | E48 | BILL TO PARTY LOCATION IS NOT MAINTAINED IN ADDRESS TABLE |

| BILLTOSTCD | E39 | BILL TO PARTY STATE CODE IS NOT MAINTAINED IN ADDRESS TABLE |

| CESSRATE | E26 | CESS RATE IS NOT VALID |

| CGSTRATE | E23 | CGST RATE IS NOT VALID |

| DOCUMENTTYPE | E04 | THE GIVEN DOCUMENT TYPE IS NOT VALID |

| FKDAT | E14 | INVOICE DATE IS IN DIFFERENT PERIOD |

| FKIMG | E21 | QUANTITY IS NOT AVAILABLE IN THE INVOICE DOCUMENT |

| FROM_ADDR1 | E53 | SELLER ADDRESS1 IS NOT MAINTAINED IN ADDRESS TABLE |

| FROM_GSTIN | E10 | SUPPLIER GSTIN NO IS NOT MAINTAINED /INVALID |

| FROM_LGLNM | E69 | SELLER LEGAL NAME IS NOT MAINTAINED IN ADDRESS TABLE |

| FROM_LOC | E45 | SELLER LOCATION IS NOT MAINTAINED IN ADDRESS TABLE |

| FROM_PIN | E71 | SELLER PIN NUMBER IS NOT MAINTAINED IN ADDRESS TABLE |

| GSTRATE | E03 | GST RATE IS INVALID |

| HSN | E02 | HSN CODE IS NOT AVAILABLE IN THE INVOICE DOCUMENT |

| IGSTRATE | E25 | IGST RATE IS INVALID |

| IRPFROM_STATE | E68 | SELLER STATE CODE IS NOT VALID |

| MATNR | E17 | PRODUCT NAME IS NOT AVAILABLE IN THE INVOICE DOCUMENT |

| PAYERADDR1 | E65 | PAYER ADDRESS1 IS NOT MAINTAINED IN ADDRESS TABLE |

| PAYERGSTIN | E51 | INVALID PAYER GSTIN |

| PAYERLGLNM | E64 | PAYER LEGAL NAME IS NOT MAINTAINED IN ADDRESS TABLE |

| PAYERLOC | E70 | PAYER LOCATION IS NOT MAINTAINED IN ADDRESS TABLE |

| PAYERSTCD | E42 | PAYER STATE CODE IS NOT MAINTAINED IN ADDRESS TABLE |

| PAYMENTMODE | E08 | PAYMENT MODE ENTERED IN NOT VALID |

| PAYMENTMODE | E75 | PAYMENT MODE ENTERED IN NOT VALID |

| POSNR | E83 | ITEM DETAILS ARE NOT AVAILABLE IN THE INVOICE DOCUMENT |

| P_CODE | E72 | PORT CODE REQUIRED FOR EXPORT CASES |

| SGSTRATE | E24 | SGST RATE IS INVALID |

| SHIPBILLDATE | E74 | SHIPPING BILL DATE REQUIRED FOR EXPORT CASES |

| SHIPPINGBILL | E73 | SHIPPING BILL NUMBER REQUIRED FOR EXPORT CASES |

| SHIPTOADDR1 | E59 | SHIP TO PARTY ADDR1 IS NOT MAINTAINED IN ADDRESS TABLE |

| SHIPTOLGLNM | E58 | SHIP TO PARTY LEGAL NAME IS NOT MAINTAINED IN ADDRESS TABLE |

| SHIPTOLOC | E46 | SHIP TO PARTY LOCATION IS NOT MAINTAINED IN ADDRESS TABLE |

| SHIPTOPIN | E35 | SHIP TO PARTY PINCODE MUST BE BETWEEN 100000 AND 999999 |

| SHIPTOSTCD | E36 | SHIP TO PARTY STATE CODE IS INVALID |

| SOLDTOADDR1 | E56 | SOLD TO PARTY - ADDRESS1 IS NOT MAINTAINED IN ADDRESS TABLE |

| SOLDTOGSTIN | E11 | INVALID SOLD TO GSTIN |

| SOLDTOLGLNM | E55 | SOLD TO PARTY LEGAL NAME IS NOT MAINTAINED IN ADDRESS TABLE |

| SOLDTOLOC | E50 | SOLD TO PARTY LOCATION IS NOT MAINTAINED IN ADDRESS TABLE |

| SOLDTOSTCD | E33 | SOLD TO PARTY STATE CODE IS NOT MAINTAINED IN ADDRESS TABLE |

| SUPTYP | E67 | INVALID SUPPLY TYPE |

| TRANSMODE | E84 | TRANSPORT MODE IS NOT VALID |

| TRANSPORTER_ID | E05 | TRANSPORTER ID IS NOT MAINTAINED IN THE DOCUMENT |

| TRANS_DISTANCE | E07 | DISTANCE IS NOT MAINTAINED |

| TRANS_DOC_DATE | E80 | TRANS.DOC.DATE SHOULD NOT BE LESS THAN DOC.DATE |

| TRANS_DOC_NO | E82 | THE TRANSPORT DOCUMENT NUMBER AND DATE MANDATORY |

| TRANS_MODE | E06 | TRANSPORT MODE IS REQUIRED |

| UQC | E22 | UNIT IS NOT AVAILABLE IN THE DOCUMENT |

| VBELN | E01 | ITEM DETAILS ARE MISSING IN THE INVOICE |

| VEHICLE_NO | E81 | THE VEHICLE NO. AND VEHICLE TYPE IS MANDATORY |

| XBLNR | E15 | ODN IS MISSING IN THE INVOICE |

How is the calculation for No. of days?

The documents that are created from the current date up to the no of days given.

Eg: If the current date is 20.01.2020 and no of days given is 15, then data from 05.01.2020 to 20.01.2020 will be listed.

How the values of CGST, SGST, and IGST capture?

Based on the configuration of Tax code, condition type and duty type and company code, values of tax will be picked

How to view the invoice details in a full-screen mode?

Yes, there is a button ‘Full Page On/Off’ at the top near to ‘Refresh’ button. Or, full page view can be assessed through the combination keys ‘Shift + F6’.

How to view the Item Details in the cockpit?

Select the document and click the button “Item View” to view the item details in the cockpit.

Is there an option to segregate Sales and FI data?

A configuration is provided to select and deselect FI and Sales data. Based on the configuration, data can be segregated and displayed in the cockpit

The state codes are not listed as maintained in SAP. Why?

Govt. has provided the list of state codes which will be accepted by the portal. Through state code configuration in Opti-EINV, the accepted state codes will be mapped with the corresponding SAP state codes.

The UoM are not listed as maintained in SAP. Why?

Govt. has provided the list of UoM which will be accepted by the portal. Through UoM configuration in Opti-EINV, the accepted UoM will be mapped with the corresponding SAP state codes.